The chart of the week is courtesy Doug Wakefield via Safe Haven and shows that the Bank of Japan (BOJ) is a top 10 share holder in about 90% of the Nikkei 225. This after the Nikkei has been down nearly 60% since its highs in 1989. After multiple QE's that have failed to stimulate the economy and get rid of the deflationary negative interest rate scenario in Japan, this latest move by the BOJ has failure written all over it. Another down move in the Nikkei from a strengthening Yen could prove to be problematic for the BOJ going forward.

2) Keeping An Open Mind About The U.S. Stock Market

3) Watch these 3 charts when the Fed makes a rate move

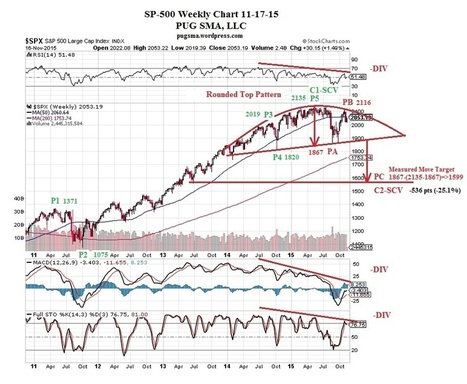

4) This chart warns that stock market investors should be on high alert

5) 3 Numbers: Eurozone deflation risk receding, but only slightly

6) The GDP In Charts: Deflation Helps Indian Economy Grow 7.4% But Nominal Growth at 6%