Some expert post-budget analysis from Dr. Charan Singh, Chief Executive, EGROW Foundation, and an eminent panel:

Cancer Survivors: If You’re A Hero, Why Are You Hiding It?

-

Cancer survivors have a great story to tell. They should tell it.

31 minutes ago

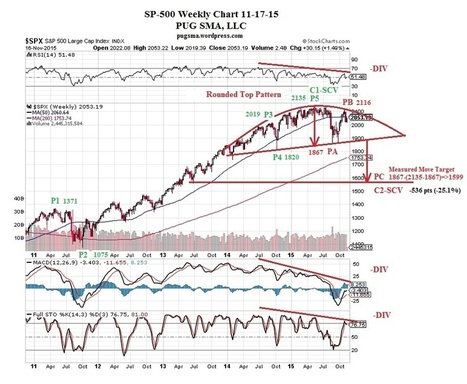

2) Keeping An Open Mind About The U.S. Stock Market

3) Watch these 3 charts when the Fed makes a rate move

4) This chart warns that stock market investors should be on high alert

5) 3 Numbers: Eurozone deflation risk receding, but only slightly

6) The GDP In Charts: Deflation Helps Indian Economy Grow 7.4% But Nominal Growth at 6%