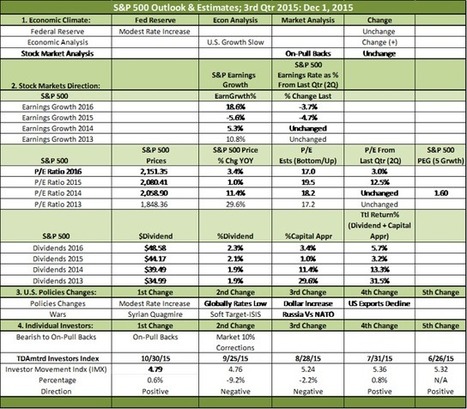

The 2016 Index for the S&P 500 will be 1,958.83, a loss of -5.8%.2015 P/E was 19.5X in our current survey (12/1/15) and last survey it was 17.3X, an increase of 12.7%.S&P 500 has gone from 91 (19%) co"

2) 4 Harbingers Of Stock Market Doom That Foreshadowed The 2008 Crash Are Flashing Red Again

So many of the exact same patterns that we witnessed just before the stock market crash of 2008 are playing out once again right before our eyes. Most of the time, a stock market crash doesn't just come out of nowhere."

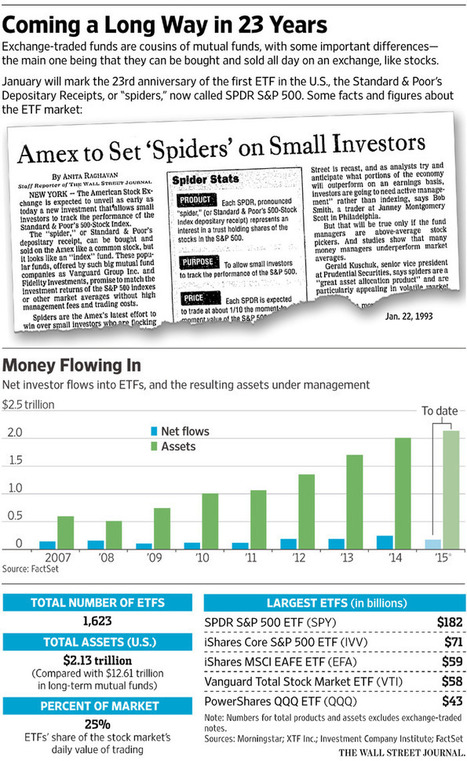

ETFs, after a spectacular run of popularity, are suddenly scaring regulators and some investors. We spell out the dangers—real and perceived."

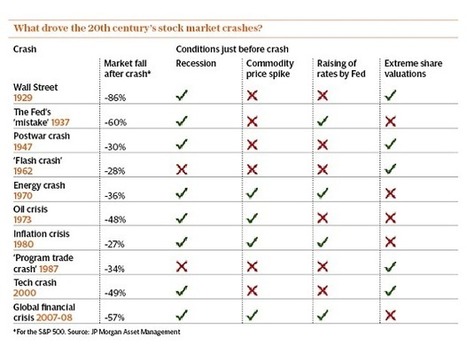

Is another bear market on its way? History’s lesson suggests there are four key ingredients and none are currently flashing red"

5) Globalization doesn't mean all stock markets are the same

Comment: It's not just about where you invest – but about the character of other investors in that market, writes Richard Evans"

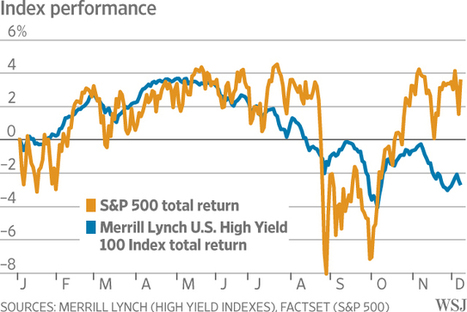

Junk bonds are headed for their first annual loss since the credit crisis, reflecting concerns that a six-year U.S. economic expansion and stock-market boom are on borrowed time."

hello sir,

ReplyDeletecan you please throw some light on Indian markets