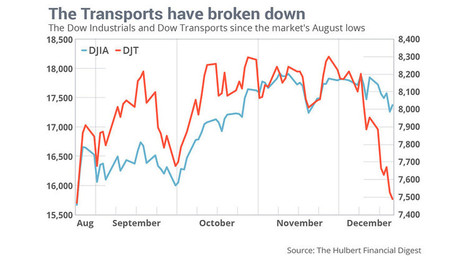

The Dow Transports are unusually weak, and a well-known investing-newsletter editor just flashed a ‘sell’ signal, writes Mark Hulbert.

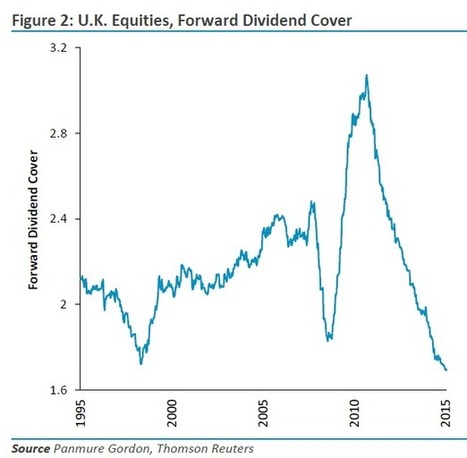

Dividend income from the FTSE 100 could face a nasty haircut next year

Wall Street Journal personal-finance columnist Jason Zweig’s new book, “The Devil’s Financial Dictionary,” is a satirical glossary of investing terms.

Big numbers from a big day in bonds.

For the fifth time in seven years Japan is back in recession, with GDP shrinking by a further 0.2% in the third quarter. Meanwhile, inflation has fallen from more than 2% to zero in just over six months.

Traders say the selloff was triggered by the abrupt liquidation of Third Avenue Management’s high-yield bond mutual fund.

No comments:

Post a Comment