Narendra Modi swept to election victory on a pro-business economic platform on May 16 2014, pushing India’s benchmark Sensex share index to a record high of more than 24,000 points.

The two-day Fed monetary policy meeting that ended on Wednesday was unlikely to stoke much volatility to the greenback, as it wasn’t followed by a press conference as usual.

With global markets experiencing wild swings in 2016, investors want to know how to invest in stocks. Here's our complete guide on how to invest now.

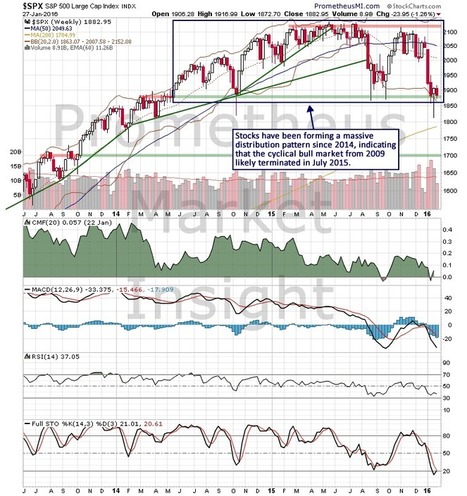

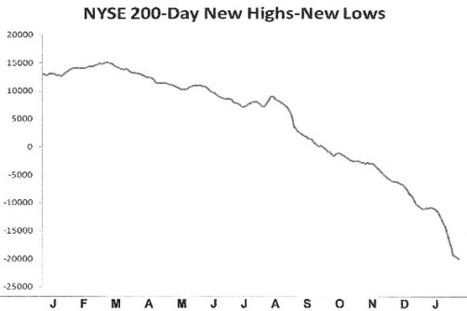

4) Stock Market On Verge Of Crash

The developing cyclical downtrend in the stock market is on the verge of accelerating into a crash.

There are two established ways of killing forward momentum and induce economic recession. One is to sharply reverse monetary policy or margin maintenance policy from very loose to very tight.

Book notes: Meb Faber’s Investing With the House: Hacking the Top Hedge Funds is a good introduction to hedge fund cloning.

No comments:

Post a Comment