Are markets manipulated?, Here is an interesting take from our partners at the The WallStreet Window:

The Ugly Truth About Stock Market Manipulation and Gold Prices - Mike Swanson

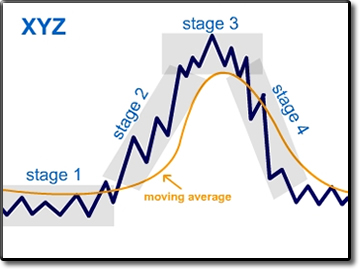

We all know the financial markets move in cycles and I have been a big advocate of using the 200-day moving averages to figure out where you are in a financial market cycle and then to invest accordingly.

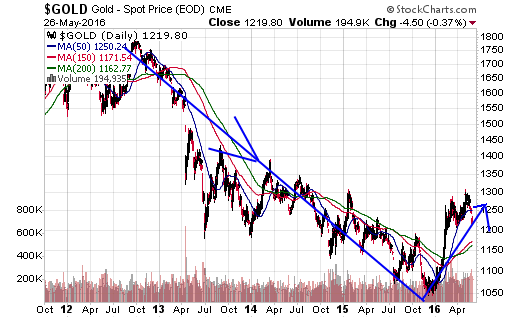

If you do that for gold the story is very simple. Gold began a stage two bull market this year when gold prices decisively went through their 200-day moving averages so much that those moving averages are now trending up and we can expect them to act as support for the next three to five years at the minimum, because that is how long most bull markets last.

Right now though most people are scared of gold and worried that the entire move this year could be a fake manipulation or that some giant drop is going to happen. Gold went up towards the $1,300 level and pulled back off of it this month.So that price action has caused peoples’ brains to get worried and for the meme of market manipulation to spread in gold.

The reality is that when a new bull market starts in something the people who buy into it are almost always professionals with a real knowledge of the sector that they are investing in attracted to cheap valuations and future potential and insiders.

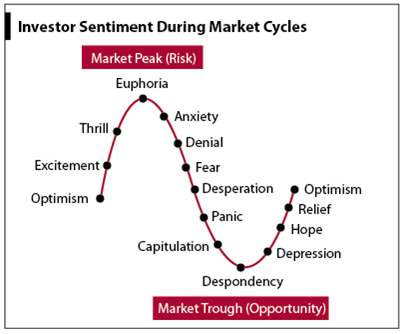

The masses tend to miss the first move and to get involved only after something goes up for months on end. Really they tend to miss the first year and start to get in the second year. We all know that big swings in investor psychology take place during market cycles and I have used this graphic in past articles to show that.

Today I want to talk to you about an important trend I have discovered and that is something interesting happens in a market when the market meme of manipulation gets popular.

Take a look at this.This is a graphic from Google Trends showing the amount of interest over time for the phrase “market manipulation.”

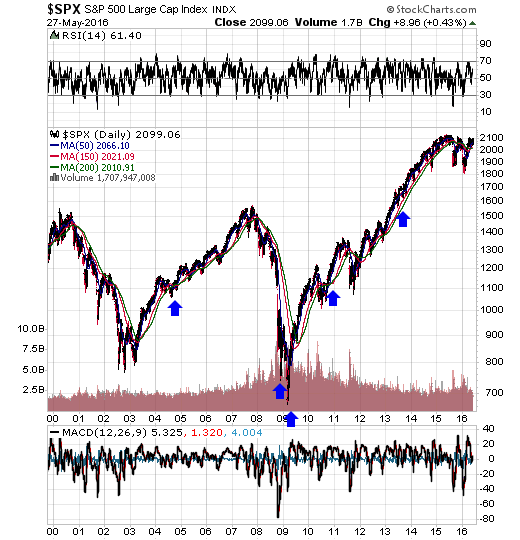

This chart spikes up when people suddenly start to type that phrase into their search engine and falls when people have no interest in it anymore. Okay now look at this chart of the S&P 500.

I’ve placed arrows on the chart to show when interest in market manipulation got high.

What I want you to notice that times in which people began to think about “stock market manipulation” and type that phrase in google search were good buy times in the stock market.

They all came after either corrections in a bull market or around the time of key stock market bottoms.

Now take a look at when people typed in the phrase “gold manipulation.” You may need to scroll the graphic to the right to see what is happening now.Yes big spikes in people searching for “gold manipulation” came after big declines in gold or pullbacks within a bull market. In fact there has been a bit of a spike in people searching for this term in the past few weeks.

The last time it spiked was in July. That of course was a great buy point for mining stocks as it marked a final bottom in many of them.The entire sector rallied off of that low and made a successful retest in January and has been going up ever since.

I got to thinking about this because of something I heard from a financial copywriter. This guy helps to create the big Stansberry and Peter Schiff style promotions you see on the internet and advertised on Yahoo Finance. What this guy said is that during a bull market people get greedy and then during a bear market they get scared.

But AFTER a bear market or big decline they simply get angry. Instead of taking responsibility for their losses and learning from them and making changes they just blame them on others. There is a reason most stock market small fries stay small fries forever.

I have been investing and trading since the late 1990’s and after that 2000-2003 bear market I saw lots of people in the mainstream stock market world blame Wall Street analysts for their losses.

They became the demons of the day. People who held overvalued stocks for big losses blamed the analysts for telling them to hold instead of admitting to themselves that they were fools to have believed in them and the tech bubble in the first place.

Then of course in 2008 people blamed the banks and stock manipulators instead of admitting to themselves that they missed the big change in trend.You see what happens is that the meme of stock manipulation becomes popular when people lose money and get angry about it.

I personally never thought about manipulation when I got into the trading world. I simply took it for granted that there is some degree of manipulation going on in all markets, but it doesn’t really matter in the long-run and in the end you need some sort of strategy for making money and picking out individual stocks and trades.

The first the time I bought a share in a mining stock was back in 2002, because stage analysis told me that gold stocks were going into a new bull market and they did. Around April of that year I went to my very first mining conference.What I found surprised me.

Just about everyone there was talking about gold manipulation, but the idea never entered my head before then and I thought it was really silly to worry about. I couldn’t see how anyone could make money trying to figure out the specifics of such things and it seemed like it was creating a giant fear for these people when they should have been bullish and buying more.

I was happy holding my stocks watching them go up while all of these people were just obsessed with manipulators.What I see clearly now is that many of those people had suffered in the bear market before that and were simply using the meme of gold manipulation to make sense of the pain they suffered.

Now fast forward to today and you can see that while gold has begun a new bull market this year interest in gold manipulation has grown anyway in the past month.That shows you that the masses are still skeptical and scared of gold and unable to pull the trigger and do buying. It shows that people are getting shaken out of rallies.

When many people are scared of manipulation it makes for a good time to invest. What is funny is when no one is thinking about manipulation it’s a sign that the sentiment is extremely bullish for a market.You see when people are making money they no longer care if something is being manipulated or not.

If you want to talk about manipulation the most obvious manipulation in the world right now is going on in front of us in the US stock market, because you can see it in corporate filings if you examine the number of buybacks many corporations have been doing. Let me show you an example.

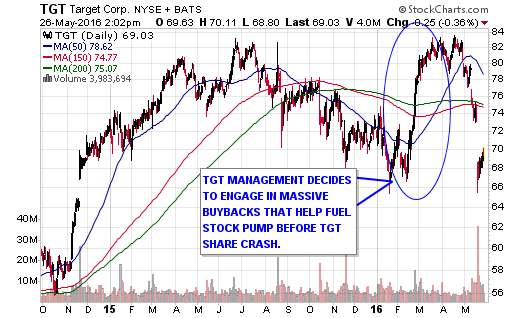

Target shares topped out last year and went into a nasty decline that continued into January.

But after making a January low they went on a magic straight up rally. Well in the first quarter ending on January 30, 2016 Target bought back $1.23 billion dollars worth of its own shares while making only $1.42 million in net income.

It was a massive share buyback operation. At the same time the Target board of directors and insiders dumped a massive amount of their own shares. In fact over the past six months they have liquidated over 15% of their own holdings and they did this before the share crash you see in May. That happened when Target released a bad earnings report that also lowered their forecast for future retail sales saying that the consumers were tapped.

This is all legal, but it looks like an obvious manipulation. This type of thing is happening with stocks all over the stock market, but no one cares. This legal type of stock market manipulation is a fact that can be demonstrated and isn’t theory.You can do the research and look it up for stocks across the board in the United States and you should do this yourself with any stocks you may own.

But no one cares, because almost everything thinks they are in a big bull market and are too lazy to look at the balance sheets and to see if there has been heavy insider selling or not in their stocks.

CNBC tells them everything is ok and so many believe in CNBC, because they do not want to do any real research or work.

The big take away is look at how no one cares about manipulation in the US stock market now while with gold some are obsessed over it. That’s the tale of two markets with one just starting a new bull market this year and one all wobbly eight years after the start of its last bull cycle.

I talked about what people need to do and look for with gold and individual stocks in an interview I did on the Jim Goddard show the other day.

For more on this visit our partner Michael Swanson on his website www.wallstreetwindow.com.

Great commentary, Rajveer. I think you are right on the ball here...we are on the verge of a new bull market in gold and other precious metals. I also really like google trends overlay on people's mentality. Re this market, I have heard a little bit about the manipulations from some high profile investors such as Eric Sprott, but no one else....its definitely a good time to get in and ride it up. I am loading up my gold & silver positions.

ReplyDeleteBest

R2R

Yes much like in 2000 there is going to be a shift out of stocks to gold, at least that's what the big guys like Soros think.

Delete