|

Indicator

|

Weekly

Level / Change

|

Implication

for

S

& P 500

|

Implication

for Nifty*

|

|

S

& P 500

|

2096, -0.15%

|

Neutral

|

Neutral

|

|

Nifty

|

8170, -0.62%

|

Neutral**

|

Bearish

|

|

China

Shanghai Index

|

2927, -0.39%

|

Bearish

|

Bearish

|

|

Gold

|

1276, 2.39%

|

Bullish

|

Bullish

|

|

WTIC

Crude

|

48.88, -0.04%

|

Neutral

|

Neutral

|

|

Copper

|

2.03, -4.41%

|

Bearish

|

Bearish

|

|

Baltic

Dry Index

|

611, 0.16%

|

Neutral

|

Neutral

|

|

Euro

|

1.132, -0.46%

|

Neutral

|

Neutral

|

|

Dollar/Yen

|

106.92, 0.37%

|

Neutral

|

Neutral

|

|

Dow

Transports

|

7765, 0.45%

|

Neutral

|

Neutral

|

|

High

Yield (ETF)

|

35.28, 0.43%

|

Neutral

|

Neutral

|

|

US

10 year Bond Yield

|

1.64%, -3.81%

|

Bullish

|

Bullish

|

|

Nyse

Summation Index

|

990, 17.45%

|

Bullish

|

Neutral

|

|

US

Vix

|

17.03, 26.43%

|

Bearish

|

Bearish

|

|

20

DMA, S and P 500

|

2083, Above

|

Bullish

|

Neutral

|

|

50

DMA, S and P 500

|

2076, Above

|

Bullish

|

Neutral

|

|

200

DMA, S and P 500

|

2015, Above

|

Bullish

|

Neutral

|

|

20

DMA, Nifty

|

8043, Above

|

Neutral

|

Bullish

|

|

50

DMA, Nifty

|

7891, Above

|

Neutral

|

Bullish

|

|

200

DMA, Nifty

|

7772, Above

|

Neutral

|

Bullish

|

|

India

Vix

|

15.97, 6.50%

|

Neutral

|

Bearish

|

|

Dollar/Rupee

|

66.97, 0.28%

|

Neutral

|

Neutral

|

|

Overall

|

S

& P 500

|

Nifty

|

|

|

Bullish

Indications

|

6

|

5

|

|

|

Bearish

Indications

|

3

|

5

|

|

|

Outlook

|

Bullish

|

Neutral

|

|

|

Observation

|

The

Sand P 500 was unchanged and the Nifty fell last week. Indicators are mixed.

Markets

are failing at resistance again. Time to tighten those stops.

|

||

|

On

the Horizon

|

China

– New loan data, Japan – Rate decision, Australia – Employment data, New

Zealand – GDP, Switzerland – Rate decision, England – CPI, Rate decision,

U.S

– Retail sales, FOMC rate decision, CPI, Canada – CPI

|

||

|

*Nifty

|

India’s

Benchmark Stock Market Index

|

||

|

Raw

Data

|

Courtesy

Google finance, Stock charts, FXCM

|

||

|

**Neutral

|

Changes less than 0.5% are considered

neutral

|

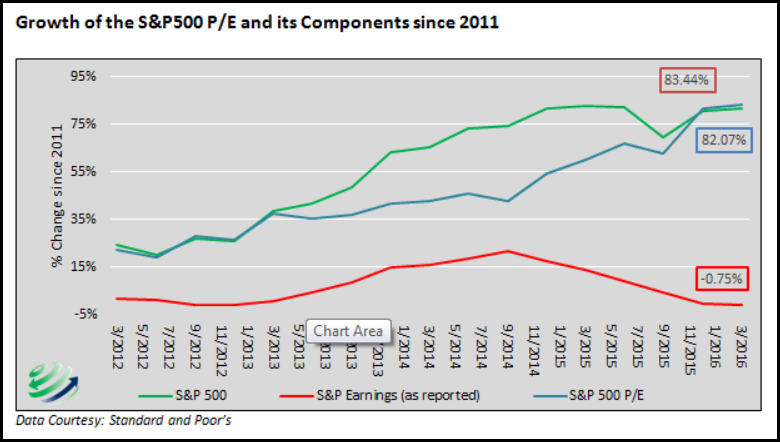

The Sand

P 500 was unchanged and the Nifty fell last week. Signals are mixed for the

upcoming week. The big move up in the Vix is suggesting some serious down side

ahead. The markets are failing at resistance and are likely to continue major

breakdowns in 2016.

The critical levels to watch are 2110 (up) and 2080 (down)

on the S & P and 8250 (up) and 8100 (down) on the Nifty. A significant

breach of the above levels could trigger the next big move in the above markets.

You can check out last week’s report for

a comparison. You can also check out support

and resistance levels of the S

and P 500 and Nifty Indices. Love

your thoughts and feedback.