|

Indicator

|

Weekly

Level / Change

|

Implication

for

S

& P 500

|

Implication

for Nifty*

|

|

S

& P 500

|

2834, 1.20%

|

Bullish

|

Bullish

|

|

Nifty

|

11624,

1.46%

|

Neutral

**

|

Bullish

|

|

China

Shanghai Index

|

3091, -0.43%

|

Neutral

|

Neutral

|

|

Gold

|

1297, -1.17%

|

Bearish

|

Bearish

|

|

WTIC

Crude

|

60.20,

1.96%

|

Bullish

|

Bullish

|

|

Copper

|

2.93, 3.39%

|

Bullish

|

Bullish

|

|

Baltic

Dry Index

|

689, -0.14%

|

Neutral

|

Neutral

|

|

Euro

|

1.1218,

-0.85%

|

Bearish

|

Bearish

|

|

Dollar/Yen

|

110.86,

0.69%

|

Bullish

|

Bullish

|

|

Dow

Transports

|

10408,

3.54%

|

Bullish

|

Bullish

|

|

High

Yield (ETF)

|

35.97,

0.73%

|

Bullish

|

Bullish

|

|

US 10

year Bond Yield

|

2.41%,

-1.81%

|

Bullish

|

Bullish

|

|

Nyse

Summation Index

|

875, -5.34%

|

Bearish

|

Neutral

|

|

US Vix

|

13.71,

-16.81%

|

Bullish

|

Bullish

|

|

Skew

|

121

|

Neutral

|

Neutral

|

|

20

DMA, S and P 500

|

2804, Above

|

Bullish

|

Neutral

|

|

50

DMA, S and P 500

|

2756, Above

|

Bullish

|

Neutral

|

|

200

DMA, S and P 500

|

2756, Above

|

Bullish

|

Neutral

|

|

20

DMA, Nifty

|

11291,

Above

|

Neutral

|

Bullish

|

|

50

DMA, Nifty

|

11013,

Above

|

Neutral

|

Bullish

|

|

200

DMA, Nifty

|

10926,

Above

|

Neutral

|

Bullish

|

|

India

Vix

|

17.19,

5.59%

|

Neutral

|

Bearish

|

|

Dollar/Rupee

|

69.40 0.32%

|

Neutral

|

Neutral

|

|

Overall

|

S

& P 500

|

Nifty

|

|

|

Bullish

Indications

|

10

|

12

|

|

|

Bearish

Indications

|

3

|

3

|

|

|

Outlook

|

Bullish

|

Bullish

|

|

|

Observation

|

The S

and P 500 and the Nifty rallied last week. Indicators are bullish for the

week.

The

markets are on the verge of a great depression

style collapse. Watch those stops.

|

||

|

On the

Horizon

|

US – Employment data, Euro Zone

–CPI, India – RBI rate decision

|

||

|

*Nifty

|

India’s

Benchmark Stock Market Index

|

||

|

Raw

Data

|

Courtesy

Google finance, Stock charts, investing.com

|

||

|

**Neutral

|

Changes

less than 0.5% are considered neutral

|

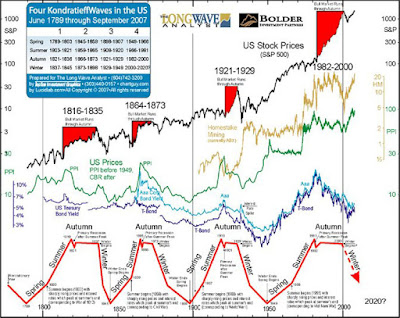

The S and P 500 and the Nifty rallied last week. Indicators are bullish for the upcoming week. QE forever from the FED is about to trigger

the deflationary collapse of the century and we are making a major secondary

top in global equity markets. The market got its oversold bounce of about

450 points but a 5 year bear market is

in the making. The trend is changing from bullish to bearish. Looking for

significant under performance in the Nifty going forward on rapidly

deteriorating macros. The India vix has exceeded the US vix suggesting there

may be a sudden catch up on the downside for the Indian market in 2019. A 5 year deflationary wave is about to

start in key asset classes like the Euro, stocks and commodities amidst a

number of bearish divergences and Hindenburg omens. We are on the verge of a multi-year great depression. Quantitative tightening by the FED is

yet to be priced in fully. The markets are still trading well over 3 standard

deviations above their long term averages from which corrections usually

result. Tail risk has been very high off late as the yield curve inverts. The critical levels to watch for the week are 2845 (up) and 2820

(down) on the S & P 500 and 11700 (up) and 11500 (down) on

the Nifty. A significant breach of the above levels could trigger

the next big move in the above markets. You can check out last week’s report for

a comparison. Love your thoughts and feedback.