Here are some insights from the currency strategists at dailyfx.

They cover the fundamentals and technicals of key Forex pairs and other

key markets along with some of the key economic news of the day.

Today's commentary looks at whether the big market moves in November are here to stay:

Wednesday, 30 November 2016

Tuesday, 29 November 2016

Daily Forex Insight

Here are some insights from the currency strategists at dailyfx.

They cover the fundamentals and technicals of key Forex pairs and other

key markets along with some of the key economic news of the day.

Today's commentary looks at oil and the Canadian Dollar ahead of the OPEC meeting:

Monday, 28 November 2016

Daily Forex Insight

Here are some insights from the currency strategists at dailyfx.

They cover the fundamentals and technicals of key Forex pairs and other

key markets along with some of the key economic news of the day.

Today's commentary looks at the macro themes in play this week:

Sunday, 27 November 2016

Daily Forex Insight

Here are some insights from the currency strategists at dailyfx.

They cover the fundamentals and technicals of key Forex pairs and other

key markets along with some of the key economic news of the day.

Today's commentary looks at the key economic reports ahead this week like the payroll data out of the US:

Market Signals for the US stock market S and P 500 Index and Indian Stock Market Nifty Index for the Week beginning November 28

|

Indicator

|

Weekly

Level / Change

|

Implication

for

S

& P 500

|

Implication

for Nifty*

|

|

S

& P 500

|

2213, 1.44%

|

Bullish

|

Bullish

|

|

Nifty

|

8114, 0.50%

|

Neutral**

|

Bullish

|

|

China

Shanghai Index

|

3262, 1.16%

|

Bullish

|

Bullish

|

|

Gold

|

1178, -2.51%

|

Bearish

|

Bearish

|

|

WTIC

Crude

|

46.06, -0.65%

|

Bearish

|

Bearish

|

|

Copper

|

2.67, 8.13%

|

Bullish

|

Bullish

|

|

Baltic

Dry Index

|

1181, -6.05%

|

Bearish

|

Bearish

|

|

Euro

|

1.06, 0.10%

|

Neutral

|

Neutral

|

|

Dollar/Yen

|

113.08, 1.99%

|

Bullish

|

Bullish

|

|

Dow

Transports

|

9044, 2.12%

|

Bullish

|

Bullish

|

|

High

Yield (ETF)

|

36.09, 1.32%

|

Bullish

|

Bullish

|

|

US

10 year Bond Yield

|

2.37%, 1.58%

|

Bearish

|

Bearish

|

|

Nyse

Summation Index

|

34, 118.39%

|

Bullish

|

Neutral

|

|

US

Vix

|

12.34, -3.97%

|

Bullish

|

Bullish

|

|

20

DMA, S and P 500

|

2152, Above

|

Bullish

|

Neutral

|

|

50

DMA, S and P 500

|

2156, Above

|

Bullish

|

Neutral

|

|

200

DMA, S and P 500

|

2103, Above

|

Bullish

|

Neutral

|

|

20

DMA, Nifty

|

8301, Below

|

Neutral

|

Bearish

|

|

50

DMA, Nifty

|

8544, Below

|

Neutral

|

Bearish

|

|

200

DMA, Nifty

|

8144, Below

|

Neutral

|

Bearish

|

|

India

Vix

|

17.61, -1.08%

|

Neutral

|

Bullish

|

|

Dollar/Rupee

|

68.52, 0.50%

|

Neutral

|

Bearish

|

|

Overall

|

S

& P 500

|

Nifty

|

|

|

Bullish

Indications

|

11

|

9

|

|

|

Bearish

Indications

|

4

|

8

|

|

|

Outlook

|

Bulllish

|

Bullish

|

|

|

Observation

|

The

S and P 500 and the Nifty rallied last week. Indicators are bullish.

The

oversold bounce has turned overbought and downside is about to resume. Time

to watch those stops.

|

||

|

On

the Horizon

|

China

- PMI, Euro zone – German employment data, CPI, Euro Zone CPI, Switzerland – GDP,

Canada - Employment data, GDP, U.S – Consumer confidence, Personal

consumption expenditure, GDP, ISM data, Employment data, OPEC meet

|

||

|

*Nifty

|

India’s

Benchmark Stock Market Index

|

||

|

Raw

Data

|

Courtesy

Google finance, Stock charts, dailyfx.com

|

||

|

**Neutral

|

Changes less than 0.5% are considered

neutral

|

The S and

P 500 and the Nifty rallied last week. Signals are bullish for the upcoming

week. Sentiment indicators are back in complacent mode and a big breakdown will

likely start soon. A big move is coming very soon in the markets. Bond yields

have made a dramatic surge up and risky segments of the market like emerging

markets are breaking down on broad dollar strength. The critical levels to

watch are 2220 (up) and 2200 (down) on the S & P and 8200 (up) and 8000

(down) on the Nifty. A significant breach of the above levels could trigger the

next big move in the above markets. You can check out last week’s report for a comparison. Love your thoughts and feedback.

Thursday, 24 November 2016

Mark Mobius on the Trump Effect

In a recent interview on CNBC TV 18, legendary investor Mark Mobius discusses the recent under performance by emerging markets post the Trump election win. Here are the details:

Wednesday, 23 November 2016

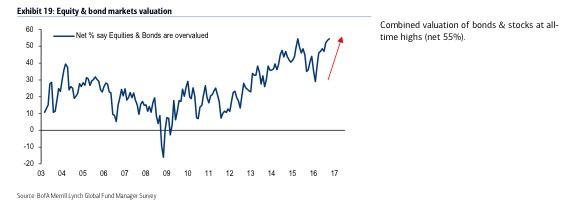

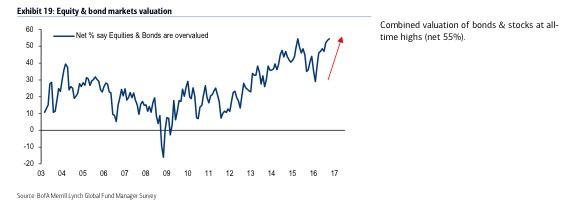

Chart of the Week - Combined Valuation of Equities and Bonds

The chart of the Week is courtesy Seventeen Mile via Seeking Alpha and shows the combined value of stocks and bonds since 2003. Thanks to the FED engineered asset bubble the combined valuation is testing all time highs made in 2015 prior to a 15% sell off in the S and P 500. Recently bonds have endured a significant and sharp sell off. Equities are likely to follow suit.

Tuesday, 22 November 2016

Daily Forex Insight

Here are some insights from the currency strategists at dailyfx.

They cover the fundamentals and technicals of key Forex pairs and other

key markets along with some of the key economic news of the day.

Today's commentary looks at the key trends that are likely to play out for the rest of the year:

Monday, 21 November 2016

Daily Forex Insight

Here are some insights from the currency strategists at dailyfx.

They cover the fundamentals and technicals of key Forex pairs and other

key markets along with some of the key economic news of the day.

Today's commentary looks at the surging dollar and the S & P 500:

Recent Big Moves in Key Markets

A very interesting video from the Financial Times that looks at some very big moves in some key asset classes across the globe. This includes the recent rout in global bonds and emerging market currencies following the election of Donald Trump as the 45th US president:

Saturday, 19 November 2016

Market Signals for the US stock market S and P 500 Index and Indian Stock Market Nifty Index for the Week beginning November 21

|

Indicator

|

Weekly

Level / Change

|

Implication

for

S

& P 500

|

Implication

for Nifty*

|

|

S

& P 500

|

2182, 0.81%

|

Bullish

|

Bullish

|

|

Nifty

|

8074, -2.68%

|

Neutral**

|

Bearish

|

|

China

Shanghai Index

|

3193, -0.10%

|

Neutral

|

Neutral

|

|

Gold

|

1209, -1.27%

|

Bearish

|

Bearish

|

|

WTIC

Crude

|

46.36, 6.80%

|

Bullish

|

Bullish

|

|

Copper

|

2.47, -1.65%

|

Bearish

|

Bearish

|

|

Baltic

Dry Index

|

1257, 20.29%

|

Bullish

|

Bullish

|

|

Euro

|

1.059, -2.47%

|

Bearish

|

Bearish

|

|

Dollar/Yen

|

110.89, 3.99%

|

Bullish

|

Bullish

|

|

Dow

Transports

|

8857, 3.24%

|

Bullish

|

Bullish

|

|

High

Yield (ETF)

|

35.62, 1.39%

|

Bullish

|

Bullish

|

|

US

10 year Bond Yield

|

2.34%, 10.30%

|

Bearish

|

Bearish

|

|

Nyse

Summation Index

|

-182, 39.02%

|

Bullish

|

Neutral

|

|

US

Vix

|

12.85, -9.32%

|

Bullish

|

Bullish

|

|

20

DMA, S and P 500

|

2143, Above

|

Bullish

|

Neutral

|

|

50

DMA, S and P 500

|

2146, Above

|

Bullish

|

Neutral

|

|

200

DMA, S and P 500

|

2096, Above

|

Bullish

|

Neutral

|

|

20

DMA, Nifty

|

8469, Below

|

Neutral

|

Bearish

|

|

50

DMA, Nifty

|

8633, Below

|

Neutral

|

Bearish

|

|

200

DMA, Nifty

|

8131, Below

|

Neutral

|

Bearish

|

|

India

Vix

|

17.81, 2.53%

|

Neutral

|

Bearish

|

|

Dollar/Rupee

|

68.15, 0.90%

|

Neutral

|

Bearish

|

|

Overall

|

S

& P 500

|

Nifty

|

|

|

Bullish

Indications

|

11

|

7

|

|

|

Bearish

Indications

|

4

|

10

|

|

|

Outlook

|

Bulllish

|

Bearish

|

|

|

Observation

|

The

S and P 500 rallied and the Nifty fell hard last week. Indicators are mixed.

The

oversold bounce is largely over and downside is about to resume. Time to watch

those stops.

|

||

|

On

the Horizon

|

Japan

- CPI, U.K – Budget, GDP, U.S – Trade balance, Durable goods, FED minutes

|

||

|

*Nifty

|

India’s

Benchmark Stock Market Index

|

||

|

Raw

Data

|

Courtesy

Google finance, Stock charts, dailyfx.com

|

||

|

**Neutral

|

Changes less than 0.5% are considered

neutral

|

The S and

P 500 rallied and the Nifty fell hard last week. Signals are mixed for the

upcoming week. Market momentum and breadth have been showing divergences for

months now and sentiment indicators are back in complacent mode and a big

breakdown will likely start soon. A big move is coming very soon in the markets.

Bond yields have made a dramatic surge up and risky segments of the market like

high yield and emerging markets are breaking down on broad dollar strength. The

critical levels to watch are 2190 (up) and 2170 (down) on the S & P and 8200

(up) and 8000 (down) on the Nifty. A significant breach of the above levels

could trigger the next big move in the above markets. You can check out last

week’s report for a comparison. Love your thoughts and feedback.